High-Impact Ideas

Recent Posts

Monthly Reporting Process Best Practices

Monthly Reporting Process Best Practices

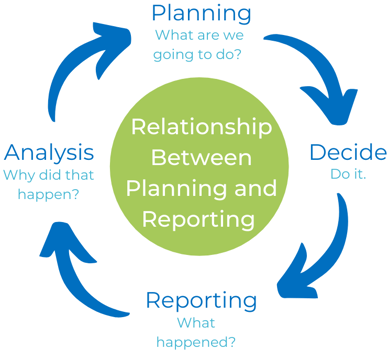

Monthly reporting is the natural culmination of the planning process, but it is not the end goal of the planning process. In fact, the planning, reporting, and decision-making cycle is the foundation for sustaining a healthy, growing business because it helps you better plan your next steps… and the following steps… and the steps after that (see image).

Whether your business is large or small, there is a high probability it can benefit from better, more streamlined reporting processes, so you can plan your next steps with confidence. This document is meant to help you achieve that goal.

When you finish this document, you will understand the leading best practices for the modern monthly reporting process, and you will gain a glimpse into where reporting practices may go in the future. You will also understand how you can transform your company’s performance by shifting the focus of your monthly financial review meetings.

Lastly, this document will give you resources you can turn to, so you know who to ask about further refining your monthly reporting practices.

Read the full article or jump to a specific section:

- The 6 Latest Best Practices Behind the Monthly Reporting Process

- 1. Deliver useful, accurate data weekly

- 2. Make up-to-date data available to key decision-makers and stakeholders at all times and in all places

- 3. Leveraging automated ERP integration to eliminate time-consuming export/import processes

- 4. Deliver timely reports in a self-service format, as well as on a schedule

- 6. Implement a strong, well-organized reporting process

- How Businesses Succeed with the Latest Predicted Monthly Reporting Process Best Practices

- 4 Steps to Driving Performance Using KPIs in Monthly Executive Financial Review Meetings

- Step 1: Annotate KPIs before the meeting

- Step 2: Use Annotated KPIs in Monthly Executive Financial Review Meetings

- Step 3: Review Significant KPI Variances Instantly

- Step 4: Clarify Actions and Reinforce Accountability

- Summing It All Up – How to Improve Your Monthly Reporting Process Best Practices

- Need Help Getting Started? Just Ask the Financial Reporting Experts at Solver

What This Document Is… and Isn’t

This document from the financial reporting experts at Solver is geared to help you improve your monthly financial reporting processes, so your company can make better, more agile decisions in response to surprising situations (such as a pandemic or recession). This document will not cover the basics of the month-end close process.

Instead, this document focuses on sharing the latest monthly reporting process best practices that can make your reporting faster and easier for everyone involved in its preparation, approval, and analysis.

As the team behind one of the most flexible and complete Corporate Performance Management solutions integrated across a wide range of ERPs, we at Solver deeply understand the importance of the month-end close process – and we know you do too.

To help you do more with your month-end close, this document helps you speed up the reporting process, improve efficiency, and better support corporate decision-making and performance at every level and in every department.

Let’s dive in.

The 6 Latest Best Practices Behind the Monthly Reporting Process

Leading global companies understand the importance of a timely and accurate reporting process. They also understand that to achieve true usability for financial reporting, transactional and forecast data must always be up to date and reliable – every minute of every day.

This is hard to accomplish in our time-strapped world, which is why the globe’s top companies use the following monthly reporting process best practices to save time, increase agility, and improve business resilience:

1. Deliver useful, accurate data weekly

It seems that nearly everything in the business world runs faster every day – which means your financial reporting needs to be faster as well.

In the past, simply running monthly reports was sufficient for the expected speed of enterprise, but the modern, tech-driven, global business landscape requires a much faster timeline. These days, companies should plan on weekly reporting for certain key items if they want to maintain a competitive edge.

Of course, saying you need weekly reporting is quite different from achieving that goal. Most global Finance department leaders are already burning the midnight oil to complete the month-end close process on time, and they would be hard-pressed to quadruple their reporting frequency.

The time-saving solution to this issue lies in ERP-integrated budgeting and reporting tools, such as a Corporate Performance Management (CPM) solution. A CPM helps optimize your reporting process by eliminating the clunky, partially-Excel-driven tasks that slow your company down.

Through integration and targeted tools, CPMs reduce or eliminate slow and error-prone manual data entry, freeing up potentially hundreds of hours of your accountants’ time every year and speeding up the reporting process, so it can be completed weekly. To support trends of more analysis and less manual work, leading CPMs also deliver hundreds of ready-to-use templates that make reporting a breeze on any timeline.

Want To Learn More About CPM Software? Here's Everything You Need To Know.

2. Make up-to-date data available to key decision makers and stakeholders at all times and in all places

To drive a company forward in uncertain times, it takes an “all hands on deck” approach that requires every one of your team members to understand where the corporation is going and why.

Studies have proven that tracking measurable progress against goals can be a great motivator on both an individual and team level, which is why many companies are choosing to make financial data available to all team members. At the very least, leading companies are sharing financial reports with Line of Business and departmental leaders in addition to key decision makers.

This approach offers strong benefits:

- It empowers the CFO and Finance department to easily collaborate with operations leaders to determine appropriate Key Performance Indicators (KPIs) that will drive positive results across the company.

- It gives Line of Business leaders and other employees a stake in your company’s success. In the past, Line of Business and departmental leaders often complained that they were held to a standard generated entirely by the “intuition” of the Finance department, as opposed to what they felt was more realistic from their “boots on the ground” perspective.

The process of drafting, printing, and distributing reports has typically been a cumbersome, costly endeavor. However, enterprises that rely on a Corporate Performance Management solution like Solver can easily generate anywhere/anytime, paperless self-service reports and scheduled, auto-distributed reports that include full drill down and built-in security measures. These reports deliver the right information to the right stakeholders at the right time – especially if you choose a CPM that delivers reports on mobile!

3. Leveraging automated ERP integration to eliminate time-consuming export/import processes

In today’s world, no one has time for manual data entry or report export and re-formatting – especially not your busy company.

By choosing to closely integrate your ERP with your financial reporting solution, you can do away with cumbersome, spreadsheet-based, export-import procedures and simply enjoy attractive, understandable reports with the click of a button.

ERP integration also empowers you to meet monthly reporting process best practices because it helps you switch away from the old method of spending 80% of your time preparing reports (with only 20% of time to spend analyzing them) to a new model of reducing your report preparation process to just 20% of your time. Imagine what you could do if you had 80% of your time left to spend gleaning key insights from analyzing your financial reports.

ERP is not the only data source you can connect to your financial reporting solution to save time. Recent trends in monthly reporting process best practices suggest that additionally integrating relevant external data sources into your financial tools can help decision makers at your company act on key information faster than ever before.

Another key practice for your monthly reporting is to integrate your planning and analysis processes seamlessly into your reporting process. This takes ERP integration to achieve and replaces the old, outdated method of having separate systems for your ERP Report Writer, your spreadsheets, your dashboard tools, your budgeting tools, and other third-party tools.

In other words, one of the best practices you can implement is to use a Corporate Performance Management system like Solver that integrates all these activities together under a single system that is tightly integrated with the company’s source data (ERP system) for easy, continuous updates of data.

4. Deliver timely reports in a self-service format, as well as on a schedule

On-demand data is the new differentiator between successful, market-leading companies and everyone else.

In our nanosecond-driven world, it is simply a fact of business that the faster your decision-makers can access key data, the faster their analysis and action phases can be. Lightning-fast action helps your company achieve desired results more quickly than your competitors – and that is what gives you the leading edge.

One of the best ways to ensure that your enterprise can access on-demand data is to choose financial planning and reporting software that makes it easy for various stakeholders to run their own self-service reports quickly and easily. Of course, on-demand reports should be available in addition to receiving monthly scheduled reports and participating in financial presentations.

One of the past challenges to self-service financial data lay in the fact that it was hard to track down the most recent version of a report without asking for help from the Finance department. Luckily, with new, cloud-based Corporate Performance Management financial reporting solutions, any authorized user in your company can instantly access key financial reports from anywhere, all of which will draw from a single source of financial reporting truth.

The modern business world rests on highly volatile foundations: the speed of change, the pace of globalization, and the resulting complications from each of those factors. These make it all but a necessity to use a Corporate Performance Management solution that delivers the financial data you need at your fingertips at any time.

5. Remove complexity from financial reports to make them readily understandable to all stakeholders

A great business is composed of the many brilliant minds that drive its success. However, not all people are trained in understanding accounting terminology.

As you know, great ideas come from every area of your company – and that means you need to empower every key stakeholder and potential problem solver with understandable financial information.

To deliver the best in understandable financial reporting, look for these key features in your CPM solution:

- The most commonly run reports (Profit & Loss, Balance Sheets, Cash Flow) are presented with user-friendly graphical options, like dashboards and charts that highlight key variances and trends.

- Your CPM integrates with a popular dashboard solution, such as Power BI or Tableau, so users can generate or access their own most important on-demand KPIs.

- The solution offers drill-down capabilities that simplify the appearance of the often overwhelming complexity of financial reporting while providing accessible access to additional information.

- Your CPM can automatically generate a narrative account of critical financial information, using descriptive adjectives and other language that changes in response to the most current financial data.

When choosing your Corporate Performance Management solution, ask to see these features during your demo, so you can get a clear view of how easily stakeholders and decision makers can create fully understandable financial reports.

6. Implement a strong, well-organized reporting process

The full, end-to-end monthly reporting process involves a lot of steps which must all be completed in a precise order to ensure that reporting is accurate, timely, and supports rapid decision making.

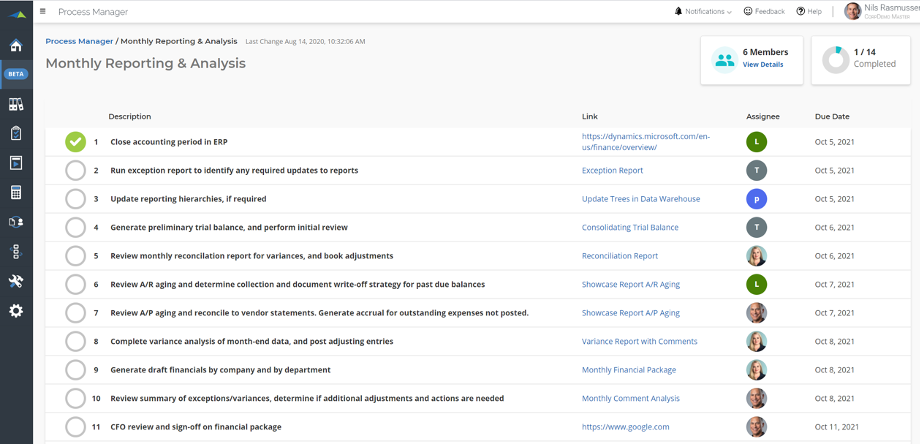

Choose a solution that integrates your monthly reporting process checklist with your CPM for best results

Some Finance departments rely on paper or digital checklists to keep them on track, but checklists only clarify what needs to be done, ignoring the equally key information of who needs to do it and when. Without specifying who is responsible for a task, accountability is lost – and your monthly reporting process will be in danger of falling behind.

Enterprises with an eye on efficiency can choose to stay organized and follow monthly reporting process best practices by using a planning checklist tool that is integrated directly into their financial planning and reporting software. This not only saves time with the monthly reporting process, it also eases the strain during planning, budgeting and forecasting activities because an integrated checklist tool can make it fast and easy for your team to stay on top of your company’s finances.

In particular, with finance teams working from home or being located at different offices, having an online, integrated, month-end checklist tool can be of invaluable help to support a faster close and to let all constituents easily follow each stage in the closing and reporting process.

An integrated checklist planning tool such as the Solver Process Manager (image above) can help your team develop repeatable processes for monthly reporting, annual budgeting, and other frequently completed, complex tasks that rely on accountability and firm deadlines. Using a tool like the Solver Process Manager helps companies keep everything on track every month, so you can count on a smooth monthly reporting process all the time.

How Businesses Succeed with the Latest Predicted Monthly Reporting Process Best Practices

Over time, accounting practices evolve and change. Many emerging trends later become best practices. Here at Solver, our financial reporting experts have noticed a few recent trends that we suspect will become best practices for all Finance departments in the very near future.

These include:

- Increased reporting transparency

Smart solutions can come from any department or area of a company, which is why large and small organizations are now encouraging a greater number of employees to read and analyze monthly financial reports.

The financial reporting and planning experts at Solver predict that this trend will grow in popularity due to the ease of scheduled report delivery, understandable reporting flexibility, and self-service reporting capabilities that make it fast and easy to securely share financial data across the company.

- Cloud-based systems for reporting, even if you have on-premises ERP

The COVID crisis and the rise of the home-based workforce accelerated the leap to the cloud for many enterprises, but not always with a cloud ERP migration. Instead, savvy business leaders from a range of industries chose to leverage cloud gateways and connectors that enabled on-premises ERP to seamlessly integrate with a cloud-based CPM solution for real-time reporting and planning capabilities.

To help, our experts developed the Solver Hybrid Cloud Connector, which makes it easy and elegant for companies to securely access anytime/anywhere financial planning, budgeting, forecasting, and reporting capabilities without having to rely on slow and clunky integration processes.

Solver Hybrid Cloud Connecter integrates a wide range of on-premises ERP solutions with the cloud-based Solver Corporate Performance Management solution.

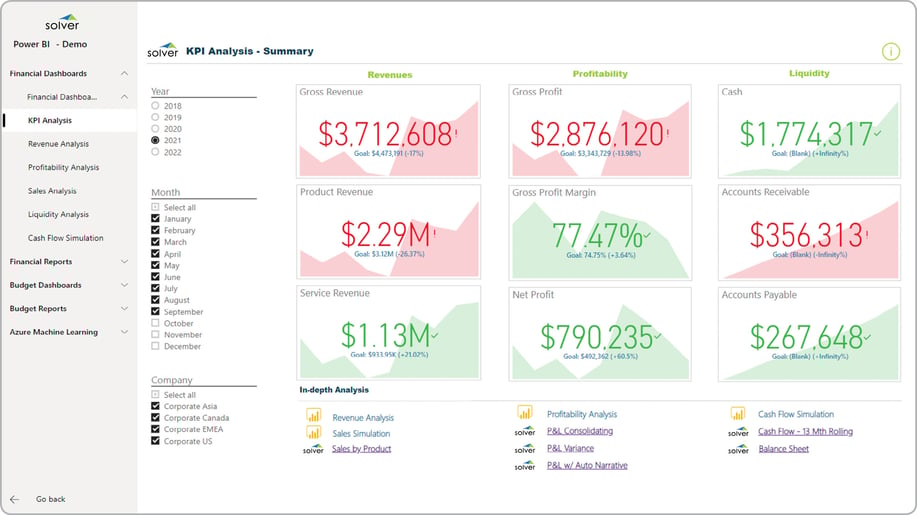

- Linking month-end reports to financial dashboards

By offering structured financial reports that include drill-downs to transactions and visual interactive graphical dashboards and charts, your company can better ensure that authorized users can perform appropriate trend analyses.

Our experts predict that this practice will be especially important for remote working environments in which the Finance team will not be available to provide explanations and context for financial data at all times.

Properly built dashboards are flexible, useful, and deliver at-a-glance information that leaders can easily drill down into.

Here are a few samples:

- KPI Analysis Dashboard (interactive – try it yourself!)

- Sales Opportunity Closure Probability Dashboard (interactive – try it yourself!)

- Budget Summary Dashboard (interactive – try it yourself!)

- Marketing Budget Simulation Dashboard (interactive – try it yourself!)

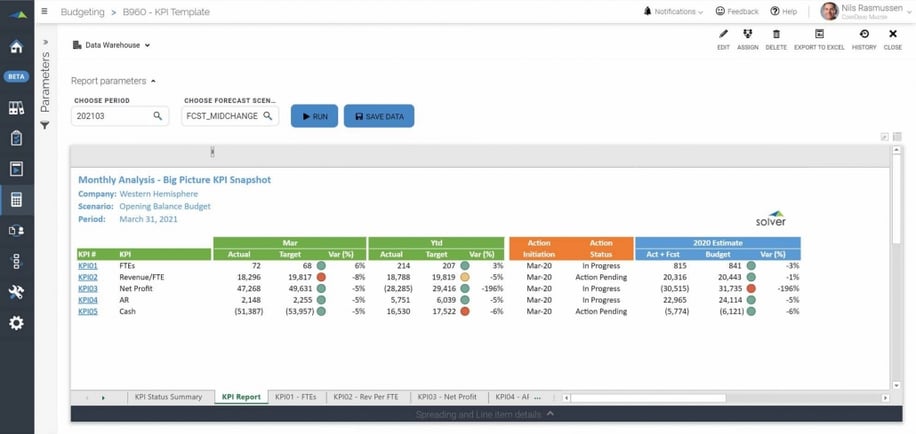

- Managing the business with KPIs and letting financial statements be the backup in monthly financial review meetings

While core financial statements including Profit & Loss, Balance Sheet, and Cash Flow are essential and required for monthly decision-making, they are not necessarily the best tools to drive a performance-focused culture for a company.

The key to implementing and maintaining a performance-focused culture at your organization is to shift the focus from financial reporting to KPI reporting.

Here at Solver, we predict that the trend of managing the business with KPIs will have a significant impact for companies that implement it properly.

To best drive performance, you will want to use carefully selected KPIs in the monthly executive financial review meetings. Appropriate KPIs should link to the goals supporting your corporate strategy.

To help you get started with this transformative practice, we have outlined steps below that can assist you in effectively using KPIs to drive your monthly executive financial review meetings.

Before you begin tracking your KPIs, however, you will want to make sure you have clearly outlined your top KPIs and goals. Corporate Performance Management solutions are geared to help you create and track your KPIs, which is why Solver offers easy-to-use strategies and goals input form to get you started.

4 Steps to Driving Performance Using KPIs in Monthly Executive Financial Review Meetings

A leading company with a performance-focused culture will have department managers or Line of Business managers review the KPIs they are responsible for prior to each monthly executive financial review meeting. (This means that the first step for the meeting actually occurs a few days before the meeting.)

Step 1: Annotate KPIs before the meeting

Using a good CPM tool like Solver that allows for input of comments tied to KPIs and variances, department managers or Line of Business managers should enter comments while reviewing KPIs.

Comments should:

- Explain KPI issues (issues are indicated by a red “traffic light” on the report)

Before commenting, the department manager should “read the traffic lights,” meaning that they should drill down into KPIs that display red traffic lights, which indicate an issue. A good Corporate Performance Management solution will provide relevant information in the drill down, including financial statements, operational reports such as sales reports, and other key data so that managers can appropriately analyze the issue and explain their findings.

As an example, a Profit & Loss report could help explain why the profit margin KPI is below the set target (and thus shows a red traffic light). The department manager would use the related drill-down information to explain the reasons for any issues.

- Make suggestions for resolution and indicate the expected resolution timeline

After performing their analysis, the Line of Business or department manager should additionally supply supporting commentary that suggests HOW the issue should be resolved, as well as WHEN they expect that resolution will show an effect.

This documentation helps place the issues in context and creates accountability for issues to be taken care of without requiring time-consuming executive involvement.

A good CPM should offer various commenting capabilities, including:

Step 2: Use Annotated KPIs in Monthly Executive Financial Review Meetings

Once the analysis and recommendations have been entered, the company can begin monthly financial review meetings that leverage the company’s annotated KPIs.

Typically, the meeting should start with a KPI report/dashboard that shows the status of all the corporate-level KPIs. In the image below, traffic lights indicate issues with KPIs. Additional useful KPI reports include:

- Annual Budget KPI Report

- Top 10 KPI Report with 13 Month Rolling Trend Analysis

- Strategic KPI Report

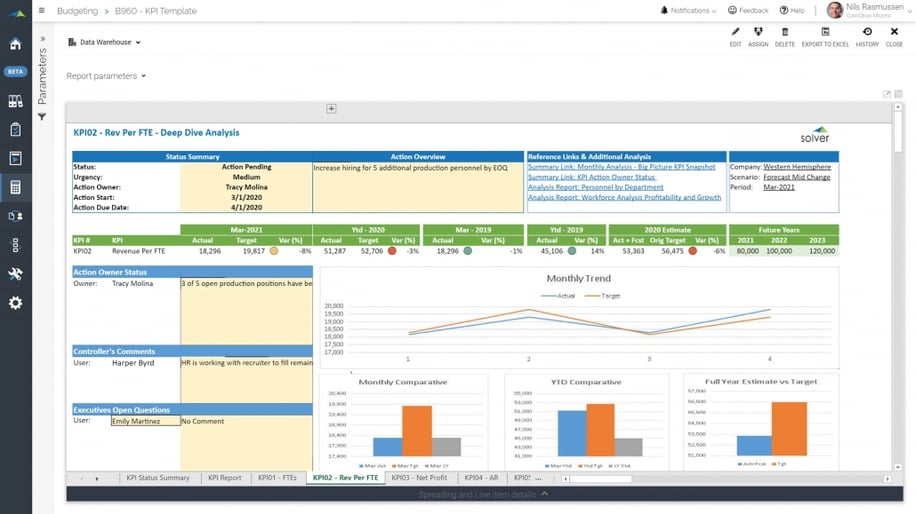

Step 3: Review Significant KPI Variances Instantly

When a KPI shows an interesting variance from target (very good or very bad variances), the meeting leader can drill down from the KPI and into the underlying financial statements.

Making KPI drill downs immediately available during the monthly finance meeting can drive agility because specific KPIs that require review will have the supporting data they need to prompt discussion and decision making.

KPI variance reports are critical tools for your business, so you should make sure your Corporate Performance Management solution offers a wide range of these reports, including:

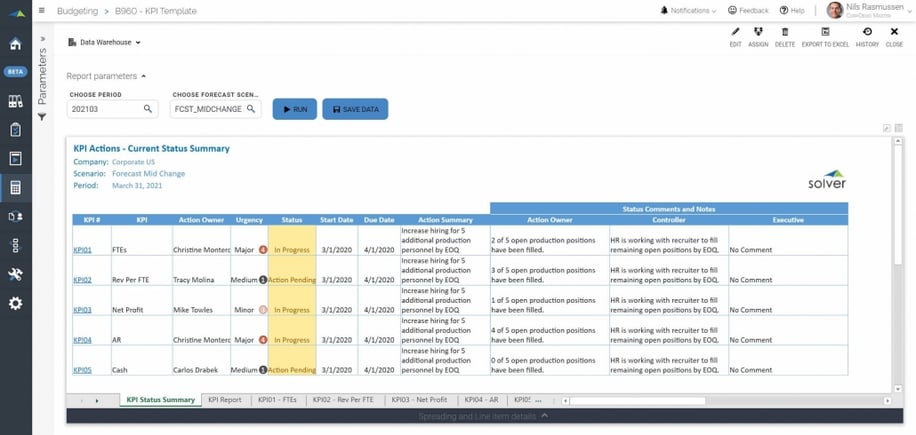

Step 4: Clarify Actions and Reinforce Accountability

At the end of the meeting, the leader should run a report that summarizes all action items from the KPIs that required action, thus ensuring that each team member clearly understands the issues and proposed resolutions. The report should also improve accountability across the company by clearly naming who is responsible for each action.

As you can see, using annotated KPIs can make monthly executive financial review meetings faster and more efficient because all comments and suggestions from Line of Business or department managers will already be available before the monthly finance review meeting begins.

With this annotation in place, the monthly meeting can move forward swiftly and maintain focus on the big issues that truly require executive feedback. The documentation will also help with a review of issues from the prior month and make it easier to assess the status of planned resolutions.

When done in a manner that supports monthly reporting process best practices, shifting the focus to KPIs for the monthly finance review meetings should significantly drive performance for mid-sized businesses that do not have a team of analysts. Monthly executive finance meetings using annotated KPIs will help these companies leverage the cutting edge in monthly reporting process best practices, acting more decisively in response to their monthly reporting results.

Summing It All Up – How to Improve Your Monthly Reporting Process Best Practices

In our “new normal” of working from home, cloud technology creates the foundation for seamless, effective, and rapid financial reporting. Cloud technology also makes it easier to implement the 6 key monthly reporting process best practices mentioned in this article.

To improve your company’s reporting processes, make sure that you:

- Increase reporting frequency

- Improve data accessibility for all stakeholders

- Save hundreds of hours with automated ERP integration

- Ensure accurate reports are always available

- Remove complexity from financial reports

- Encourage accountability with a reporting process

The CPM you choose to help you perform these tasks should also integrate cleanly with user productivity tools like Excel or dashboards like Power BI or Tableau for professional, interactive visualizations that make your month-end reports easy to understand and easy to act on.

In addition, companies can boost their agility by shifting their focus to KPI reporting during their monthly finance reviews. This transformative practice encourages a performance-driven culture across the organization.

Need Help Getting Started? Just Ask the Financial Reporting Experts at Solver

Now that you have read this document, it is time for you to make a change and transform your monthly reporting processes. But updating your traditional processes to align with monthly reporting process best practices can be a challenge.

Fortunately, you have help.

With Solver, you will have access to hundreds of financial planning templates and reports, plus our extensive template glossary and experienced staff who are always happy to share their expertise and help you along every step of your financial transformation.

If you have questions about how you can streamline and improve your monthly reporting process, our support experts are ready to help you get the most out of Solver’s flexible and robust financial planning and reporting tools. Solver is committed to helping you set up your business practices for success, so you can proceed confidently into your business’s financial future.

Learn More about Monthly Reporting Process Best Practices – Ask the Experts!

TAGS: Reporting, Solver, Acumatica, planning, GP, excel, ax, Microsoft Dynamics, Dynamics 365 Business Central, dynamics 365 finance, SAP, Sage, D365, NAV, Intacct, report, SL, dynamics, report with variances, process improvement, best practices, Web-based Reporting, B1, Cloud-based, Scheduling Reports, reporting & analysis, Enterprise Reporting, Financial Reporting and Analysis, bydesign, automated reporting, real-time reporting, SAP B1 Reporting, reports, reporting tools, Financial Report Writing, financial reports, drill down reports, operational reporting, cloud reporting, Mobile Reporting, best reporting tools, Cloud based financial reporting, Report Sharing, financial reporting software, Cloud-based Reporting, planning process, live reporting, ERP Reporting, financial reporting, Dynamics 365 reporting, planning best practices, PL Report, Automated Reports, Cloud Financial Reporting, Web Reporting, Reporting for Microsoft Dynamics GP, Creating Finance Reports, Cloud based reporting tools, SAP Business One Reporting

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)

Global Headquarters

Solver Suite

Core Subscription

Company and Resources

© Copyright 2024, Solver All rights reserved.LegalPrivacy

QuickStart and Template Marketplace Overview (2 min) |QuickStart and Template Marketplace Setup (10 min)